ss Australia is erupting in controversy after a political–economic bombshell detonated at the heart of power: Former RBA Governor Philip Lowe has stunned the nation, declaring that Australia’s prolonged inflation wasn’t driven by global forces but by “Labor’s uncontrolled spending.” Moments later, the current RBA Governor delivered an even sharper shock, warning that the country is now facing a home-grown inflation crisis that strikes directly at the government’s economic credibility

A major political and economic controversy has erupted across Australia after former Reserve Bank Governor Philip Lowe suggested that the nation’s prolonged inflationary pressures were worsened by what he described as excessive government spending under the Labor Government.

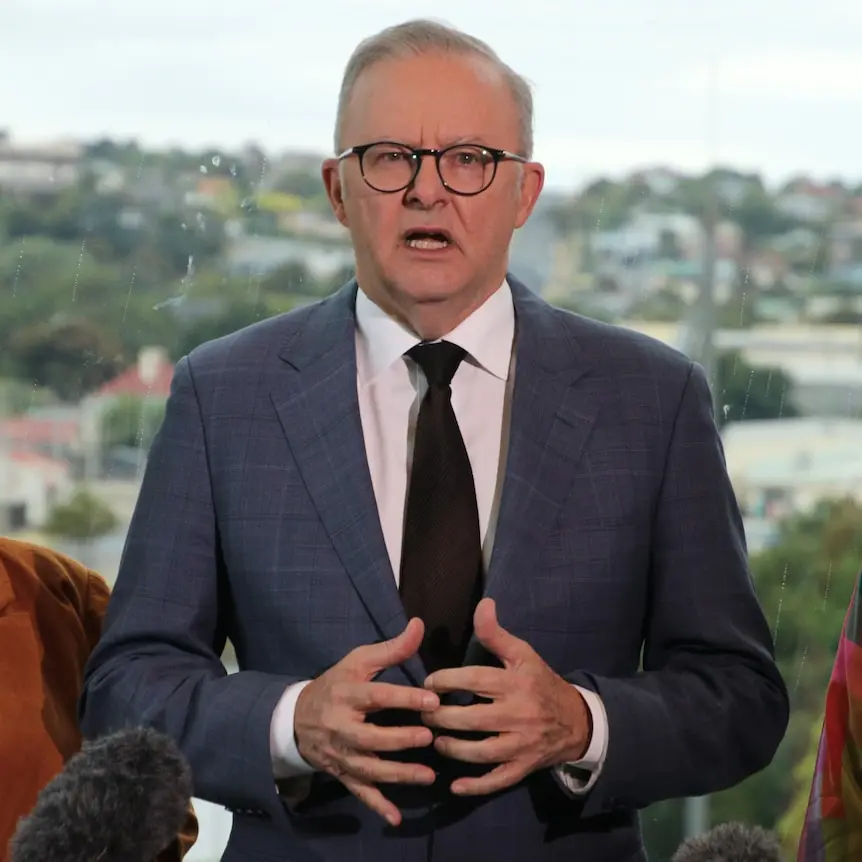

Lowe’s remarks, echoed by comments from the current RBA Governor about a “home-grown inflation problem,” have triggered an intense national debate and renewed scrutiny of the Albanese Government’s fiscal strategy.

Critics argue that Australia is now facing a “generational debt bomb,” with interest payments climbing so rapidly that, according to several commentators, the country is paying approximately $50,000 in interest every minute.

The claim has sparked widespread public anger, particularly as households struggle with rising living costs, mortgages, and persistent inflation.

In comments reported this week, Lowe reflected on the factors contributing to Australia’s inflation lingering longer than in some other advanced economies. He pointed to what he characterised as the government’s “significant fiscal expansion,” suggesting that large-scale spending programs may have added upward pressure on consumer prices.

Although Lowe did not directly accuse the government of irresponsibility, his remarks have been widely interpreted—and politically weaponised—as criticism of Labor’s approach to post-pandemic economic management.

“Inflation remained higher for longer in Australia partly because fiscal policy was too expansionary,” Lowe said. His statement immediately dominated headlines and was seized upon by critics as evidence of mismanagement.

The current RBA Governor added further fuel to the debate by noting that Australia now faces “a domestically driven inflation problem”, implying that inflation cannot be blamed solely on global disruptions such as supply chain shortages or the war in Ukraine.

The Albanese Government has strongly defended its policies, arguing that its spending measures were necessary to support essential public services, strengthen long-term productivity, and provide relief to vulnerable Australians. Government officials maintain that inflation drivers are complex and global in nature, not the result of any single political decision.

A spokesperson for the Treasurer stated:

“Australia’s inflation challenges are consistent with global trends. The government’s policies are targeted, responsible, and designed to support families without worsening long-term inflation.”

Labor also argued that inherited structural deficits and global shocks have played a central role in shaping current economic conditions.

Opposition leaders responded swiftly and forcefully to Lowe’s remarks. Shadow Treasurer Angus Taylor argued that the comments vindicate long-standing concerns about the government’s spending levels.

“This confirms what Australians already feel — Labor’s spending is making inflation worse and driving up interest rates,” Taylor claimed. “Families are paying the price for the government’s failure to manage the economy responsibly.”

The Opposition insists the government should cut spending immediately to ease inflation and help the Reserve Bank bring interest rates under control.

Critics outside Parliament have intensified their warnings about the long-term implications of rising national debt. Financial analysts and political commentators have used the phrase “generational debt bomb” to describe the scale of borrowing and the long-term obligations that future taxpayers may inherit.

According to estimates circulated by economic commentators, federal interest payments have risen so sharply that Australia is now paying roughly $50,000 per minute in interest alone. While this figure depends on model assumptions and fluctuating bond rates, it has nonetheless captured public attention and stirred anxiety among voters.

Social media has been filled with posts expressing frustration and disbelief:

“We are drowning in debt while the government keeps spending,” one user wrote. “How do they expect young Australians to afford a future with debt growing like this?”

Adding to the criticism are Labor’s proposed tax changes affecting superannuation, investment earnings, housing, and family businesses. Supporters argue these reforms aim to close loopholes and ensure tax fairness. However, critics say the changes place additional pressure on everyday Australians already struggling with rising costs.

Several business groups have warned that additional taxes may deter investment or strain small enterprises.

A spokesperson for the Council of Small Business Organisations Australia stated:

“We are already under pressure from inflation and interest rates. Additional taxes will make it harder for small businesses to survive.”

Despite the heated political rhetoric, economists remain divided on how much influence government spending has had on inflation. Many acknowledge that fiscal stimulus contributes to price pressures but argue that international factors—such as supply chain disruptions, energy shocks, and tightening monetary policy—also play major roles.

Dr. Melissa Turner, an economist at the University of Sydney, told ABC-style reporters:

“It’s overly simplistic to blame inflation on one government or one policy. Global inflation has been elevated everywhere. However, it is true that fiscal stimulus can prolong inflation if not carefully calibrated.”

As Australians face record mortgage payments and declining purchasing power, political pressure continues to mount. Recent surveys show declining confidence in the government’s ability to manage inflation effectively, though the Prime Minister continues to emphasise long-term reform over short-term political gains.

Political analyst Daniel Reid observed:

“Inflation may fall eventually, but the perception of mismanagement can linger. The government needs a clear, consistent message if it wants to restore public confidence.”

With inflation remaining stubbornly high and economic frustrations intensifying, the Albanese Government faces a challenging period ahead. The debate over spending, debt, and taxation is likely to dominate the political landscape in the coming months.

While Philip Lowe’s comments have escalated the national conversation, the broader economic picture remains complex. Whether the government can regain public trust — or whether critics’ warnings will translate into lasting political consequences — remains uncertain.