dq. A Franchise Breaks Ranks — And the Battle Over Who Gets to Watch Football Just Got Personal

When passionate football fans settle in to watch the game, they expect one thing above all: access. But in 2026, access is anything but guaranteed. What once felt like a straightforward choice of turning on the TV is now being transformed into a tangled battle over who gets to watch football — and more importantly, who decides who gets access. What began as routine negotiations about broadcast rights and distribution deals has escalated into a broader conflict that is forcing leagues, broadcasters, streaming services, and fans to confront a fundamental question: Who owns the right to view the sport?

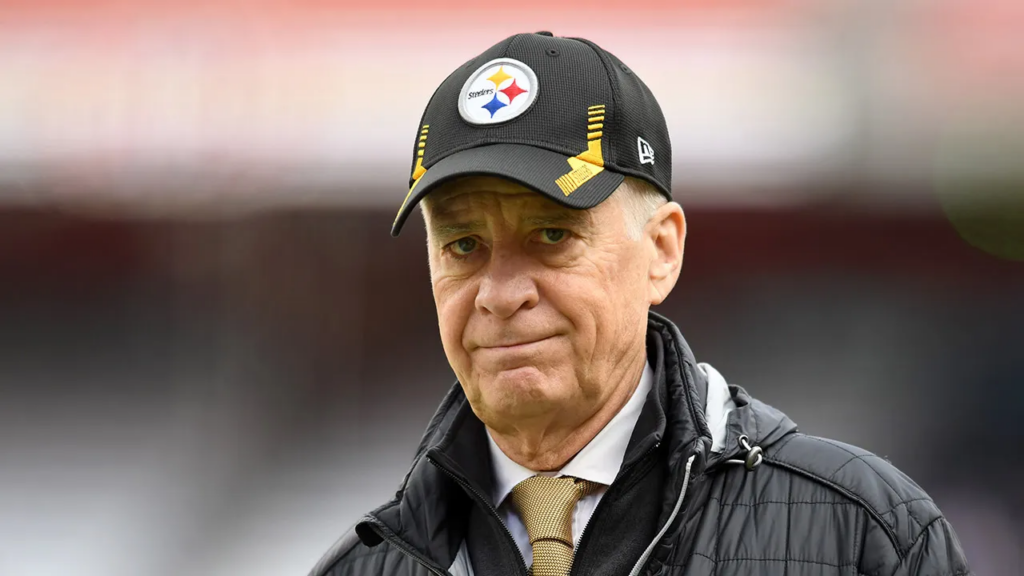

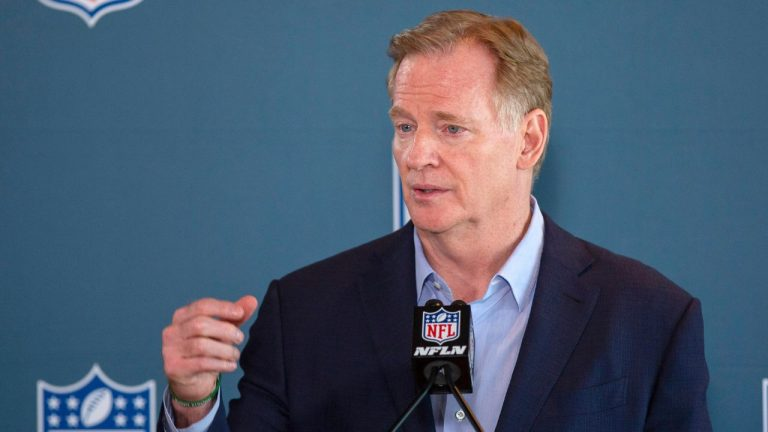

At the center of this upheaval is the National Football League (NFL), one of the biggest players in global sports media. Recent moves by the league suggest a willingness to break from long-standing broadcast traditions and experiment with new partners, even those outside the classic television ecosystem. According to recent reports, the NFL is exploring live game rights deals with non-traditional media platforms as a way of expanding reach and potentially reshaping how games are consumed in the years to come.

This proposed pivot has reverberated across the industry, highlighting tensions between legacy broadcasters and digital platforms. For decades, cable networks like CBS, NBC, Fox, and ESPN were the undisputed guardians of live football broadcasts. They held exclusive rights that ensured fans had to tune in to specific channels in order to catch every touchdown, interception, and instant replay. But the rise of streaming services — platforms like YouTube TV, Amazon Prime, and others — has upended that model, challenging the old order and giving viewers more ways than ever to watch the sport they love.

The friction between new and old media was on display in 2025 when fans found themselves caught in the middle of a high-profile contract dispute between Disney and YouTube TV. Negotiations over channel carriage and pricing stalled, leaving ESPN and other Disney channels absent from YouTube TV lineups — precisely during peak college football season. The result: fans were frustrated, games risked being blacked out for subscribers, and both companies faced public blowback from the very audience they hoped to serve.

Similar standoffs have created a ripple effect across the sports landscape. In certain markets, established sports channels pulled content from streaming services over pricing disagreements. In others, leagues are entering into shared ownership arrangements with broadcasters that blur traditional lines between rightsholder and distributor. For instance, ESPN’s recent acquisition of full control over NFL Network (including RedZone and fantasy football assets) represents a dramatic shift, with the league itself taking a financial stake in the broadcaster.

That move has profound implications. Now, the league stands to benefit directly from decisions made by one of its most influential broadcast partners. It blurs the lines between coverage and ownership in ways that may accelerate consolidation — and alter the incentives behind who gets first access to marquee games.

Outside the U.S., the scramble for broadcast rights has already produced its share of headlines. In European football, legal challenges and new contractual models are forcing changes to how fans can view the sport. A ruling by the European Court of Justice declared that fans have a right to watch football franchises across different broadcasters, potentially upending exclusive territorial rights sales that have defined the industry for decades.

Meanwhile, smaller leagues and regional franchises are also being pulled in different directions. Some have sold their broadcast rights to established networks, while others are open to innovative distribution deals that leverage digital platforms and streaming. From English football broadcasting deals worth billions to proposals for global streaming arrangements, the result is an increasingly fragmented market where the rights to watch have become as contested as the rights to play.

For fans, these battles are more than academic. They manifest in real frustrations: blackout notices on favorite games, cable channels disappearing from streaming lineups, paywalls replacing free-to-air access, or platforms refusing to carry games due to pricing disputes. From the NFL’s anti-siphoning policies, which require certain games to air on over-the-air TV to protect viewer access, to exclusive streaming windows that push some matches behind subscription fees, the rules about who gets to watch are in constant flux.

In some cases, governments are even stepping in to address the imbalance. In South Africa, for example, sports officials have publicly challenged broadcasters holding monopolies over national team coverage — arguing that no single network should control who sees the game.

All of this raises deeper questions about the relationship between sports and society. Football — whether American, European, or otherwise — has always belonged to fans first. But in the digital age, control over distribution and access has moved into the hands of media conglomerates, platform operators, and league business executives. The result is a complex ecosystem where fan access is often determined not by loyalty or geography, but by negotiations, contracts, and corporate leverage.

And as franchises consider partnerships with non-traditional media entities — spreading into streaming, digital, and global markets — the old guarantees about where and how games can be watched are dissolving. In their place is a new frontier of competition — one where the most important question for fans isn’t who will win on the field, but who will let them watch at home.