Uncategorized

AT. $1 Trillion Payday: Elon Musk Secures Historic Boost as Tesla Inc. Shareholders Approve His Biggest-Ever Compensation Plan”

At the company’s annual meeting in Austin, Texas, Tesla Inc. announced that over 75% of its voting shareholders approved a compensation package for CEO Elon Musk that could be worth up to US $1 trillion, marking what many are calling the largest-ever executive pay plan in corporate history.

What the deal entails

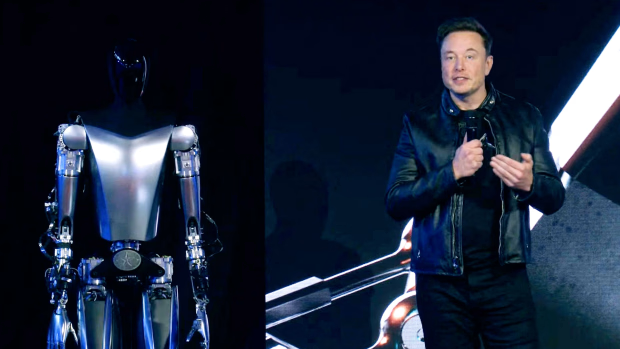

- The package is structured as a performance-equity award spanning up to a decade, and is contingent on Tesla hitting a series of ambitious milestones — among them: growing market capitalization from around US $1.5 trillion to US $8.5 trillion, delivering tens of millions of vehicles, rolling out robotaxi services, and selling humanoid robots.

- The plan would grant Musk additional shares — potentially increasing his stake in Tesla from roughly 13% to some 25% — if all conditions are met.

- Musk will not receive a traditional salary under this deal; instead the reward comes entirely in stock contingent on performance.

Why the vote matters

- For Musk, the vote is a clear vote of confidence from shareholders, reinforcing his position at the helm of Tesla as the company pivots beyond electric cars into robotics and artificial intelligence.

- For Tesla, securing this approval means leadership continuity. The board had warned that without a compelling incentive plan, there was risk of Musk shifting focus or even departing.

- For corporate governance watchers, this deal raises fundamental questions about executive compensation, target-setting, dilution of shareholder value, and the balance of power in companies where the CEO also holds substantial control. Proxy advisory firms raised concerns.

Reactions & risks

- Many institutional investors who opposed or expressed concern remained vocal. For example, Norway’s sovereign wealth fund flagged “dilution” and “key person risk” as significant issues.

- Critics argue that though the payout is contingent, the scale is staggering — potentially dwarfing all past executive compensation and raising the question: what happens if Tesla fails to hit the targets?

- Supporters argue it aligns Musk’s incentives entirely with extraordinary performance and long-term value creation — not short-term gains. The board described it as “pay-for-performance”.

What happens next

- Musk and Tesla now face the real challenge: turning the vision into results. The milestone list includes building 1 million robotaxi vehicles, selling 1 million humanoid robots, achieving tens of billions in profits, and dominating the self-driving and robotics sectors. Only then will the full package be unlocked.

- Investors will watch closely how Tesla executes in the coming years — particularly as EV growth slows globally, competition intensifies, and the ambitious robotics/AI goals remain unproven at scale.

- For governance and board dynamics, this vote may set a precedent: if CEOs are given ultra-large awards tied to moonshot goals, how will other companies structure compensation and a board’s role in vetting these deals?

Bottom line

Tesla shareholders have placed a massive wager on Elon Musk and the next chapter of Tesla’s evolution. With more than three-quarters of the vote now behind him, the CEO has both the mandate and the potential reward. But with great promise comes great risk — and the years ahead will prove whether this historic vote is justified.